The book Intelligent Investor was originally published in 1949 and today in 2022 after 73 years of long time travel this book is yet the best financial investment in stock market as stated by Warren Buffett. These book will never be out dated and will be all time favourite for him.

Hello people welcome to my another blog to value investing. In these blog I will review the book the Intelligent Investor which is the Bible of stock market.

Warren Buffett have recommended every Investor to read this book for they start there investment planning. There are two important chapters recommended by Buffett for everyone is the chapter 8 the investor and market fluctuations and chapter 20 on margin of safety. But we’ll review the whole book in these blog.

The Author Benjamin Graham is an American Economist and also well known as value Investor. He also wrote a book as ‘The security analysis‘ which also got famous. He Says that there are two types of investors in market. The first is passive/Defensive investor and the second is active or aggressive investor they both have same risk and return ratio but their ways are way too different. The defensive investor means a person who is Interested for one time Investment and to continue the cycle of investment regularly. The active or aggressive investor doesnt mean to be a full time trader it means the person who is actively reading Annual reports of the company meeting the board of directors of the company and higher management of the company. The stock market always have ups and downs as the time passes but and investor should never fall in any trap of market which make to sell the stock or buy is at any price. Ben Graham says that the stock market is like a person who controls the investor according to his moods he as named it as Mr.Market. Most investor follow the mood of Mr.Market like if Mr.Market is happy he sells stock at high price and when sad he sells the Stock at low price. Most people follow the mood of Mr.Market. It is just like throwing your money into fire. Instead Ben Graham says that to do the opposite of Mr.Market moods. The most important part of the book were ben Graham keeps on saying is that “Value is not equal to price” it means that the value of the company never depends on the market share price. Instead he says the better a company’s record and prospects, the less relationship the price of its share will have to their Book value. The investor should always focus on the diversification. The more his portfolio is diversified the lesser the risk will be to him. This was his first principal which he wants to teach us.

The second principal is that, always try to find large market capitalisation companies. The company should be in the business for more than 20 years. Company should have 50% less debt of its company assets. There should be minimum 5% annual growth return rate for minimum 5 years. I know these 5% number is less but, in 1949 when this book was published it was a normal growth rate for them.

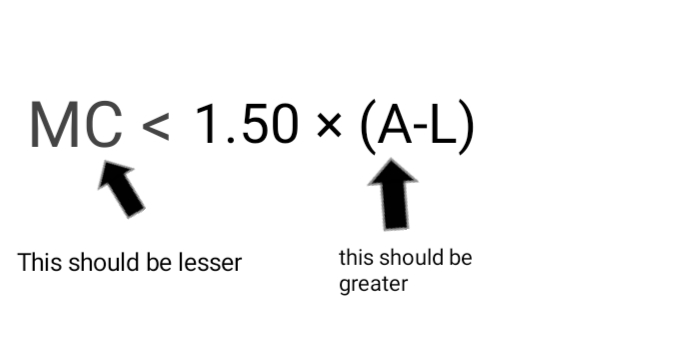

The EPS(Earnings per share) and PER (Price to earning ratio) should not exceed more than 15%. The lesser these number is the more logical it make for the valuable company. Ben Graham also share his formula were you can find out a stock which is cheap and valueable at the same time. That the most important formula of these blog. The Market capitalisation of the company should be lesser than 1.50 of Assets minus Liabilities of the company. These will gives you a defination of cheap assets as well as valuable.

Where as,

MC = Market capitalisation

A = Asset

L= Liabilities

I know this might get complicated and that’s ok. It will take a time for to fully understand it.

Let’s come to the Conclusion were we learn that Ben Graham try to teach us that always invest money in long term perspective. Try to find valuable company. Purchase those companies stock that are lower then it’s general price for Margin of safety. Thank you so for being till here I hope you’ll also like my last blog which is on “The Warren Buffett way” by Author “Robert Hagstrom” were we learn the same but in this blog we got more deeper on the value investing. Thank you

Leave a comment