The past 20 years have seen significant growth and development in the Indian stock market, with the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) playing a major role in driving this growth.

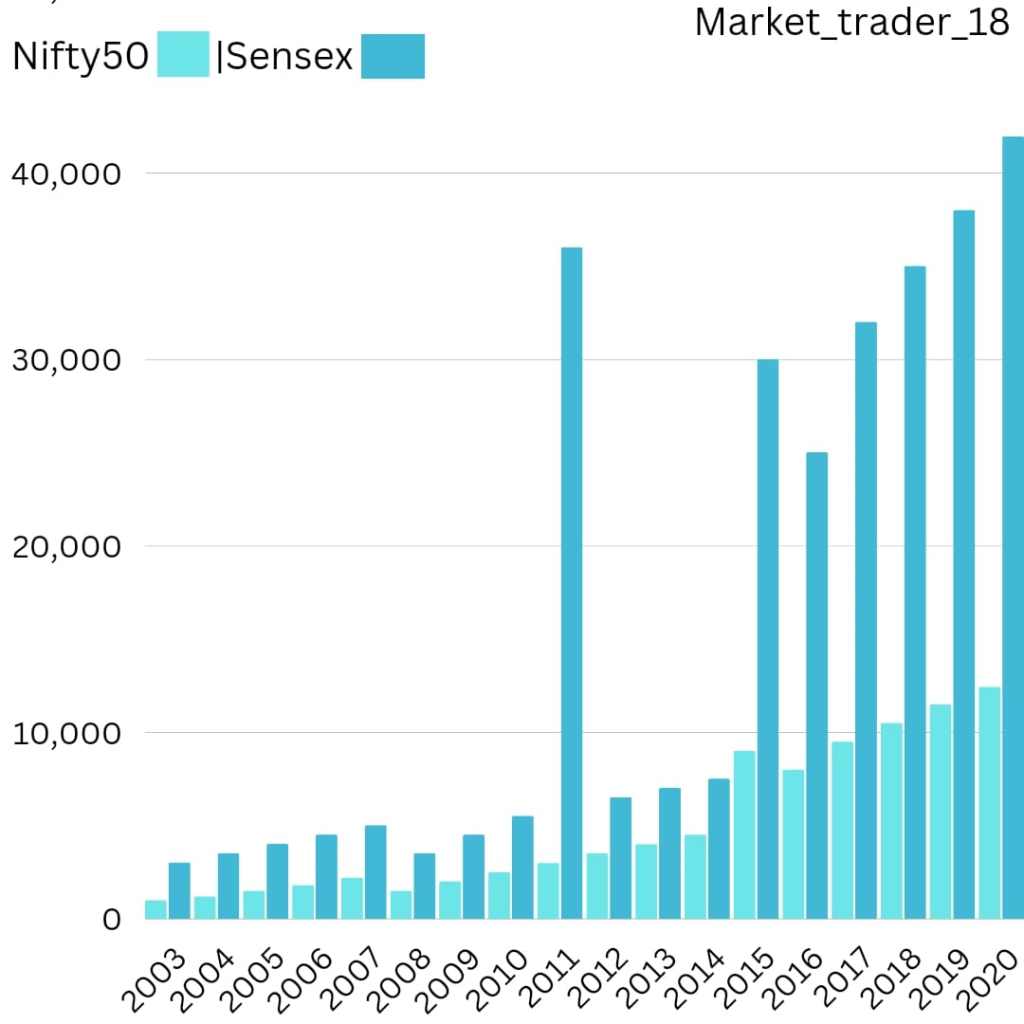

In the early 2000s, the NSE and BSE both experienced steady growth, with the NSE’s Nifty 50 index and the BSE’s Sensex index both reaching new highs. However, the global financial crisis of 2008 had a significant impact on the Indian stock market, causing both indexes to drop significantly.

Despite this setback, the market quickly recovered and continued to grow in the following years. In 2010, the NSE’s Nifty 50 index surpassed the 6,000 mark for the first time, and by 2015 it had reached the 9,000 mark. Similarly, the BSE’s Sensex index also saw significant growth, reaching the 30,000 mark in 2015.

The past five years have also seen continued growth in the Indian stock market, with both the NSE and BSE reaching new highs. In 2020, the NSE’s Nifty 50 index reached a record high of 12,430, while the BSE’s Sensex index reached a record high of 41,952.

However, due to the COVID-19 pandemic, the market saw a significant correction, but later as the vaccine started to roll out and the economy started to recover, the market again started to show positive signs.

Overall, the past 20 years have seen the Indian stock market experience steady growth, with the NSE and BSE playing a major role in driving this growth. While there have been setbacks, such as the global financial crisis of 2008 and the COVID-19 pandemic, the market has consistently bounced back and continues to offer investors opportunities for growth and returns.

Leave a comment