Harshad Mehta, also known as the “Big Bull” of the Indian stock market, orchestrated one of the largest financial scams in the country’s history in the early 1990s.

Mehta, who was a stockbroker at the time, exploited a loophole in the banking system to fraudulently inflate the prices of certain stocks. He did this by obtaining bank receipts, which were used as collateral for buying shares, through fraudulent means. He then used these receipts to borrow large sums of money from banks, which he used to buy shares of select companies. This caused the prices of these stocks to artificially inflate, and Mehta made huge profits by selling them at the inflated prices.

The scam was discovered in 1992, and Mehta was arrested and charged with multiple counts of fraud and money laundering. The Securities and Exchange Board of India (SEBI), the country’s stock market regulator, also launched an investigation into the matter.

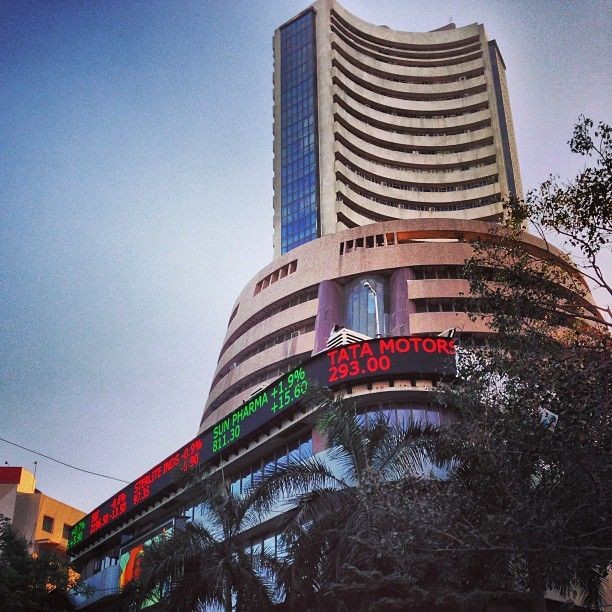

The scam had far-reaching consequences for the Indian stock market and economy. Many investors, including small retail investors, lost large sums of money as a result of the artificially inflated stock prices. The stock market also took a major hit, with the Bombay Stock Exchange (BSE) Sensex, the benchmark index of the Indian stock market, losing over 30% of its value in the aftermath of the scam.

The government also took steps to tighten regulations and oversight of the stock market in the wake of the scam. The SEBI was given more powers to regulate and investigate market activities, and new laws were passed to strengthen the legal framework for dealing with financial fraud.

Harshad Mehta was sentenced to five years in prison and fined heavily, he died while he was out on bail in 2001. The scam also led to the fall of many reputed firms and banks. The scam shook the entire financial system of India and led to reforms and tightening of regulations in the stock market.

The Harshad Mehta scam serves as a reminder of the need for strong regulatory oversight and strict enforcement of laws to prevent financial fraud and protect investors. It also highlights the importance of due diligence and caution for investors in the stock market.

Leave a comment